iedge s reit

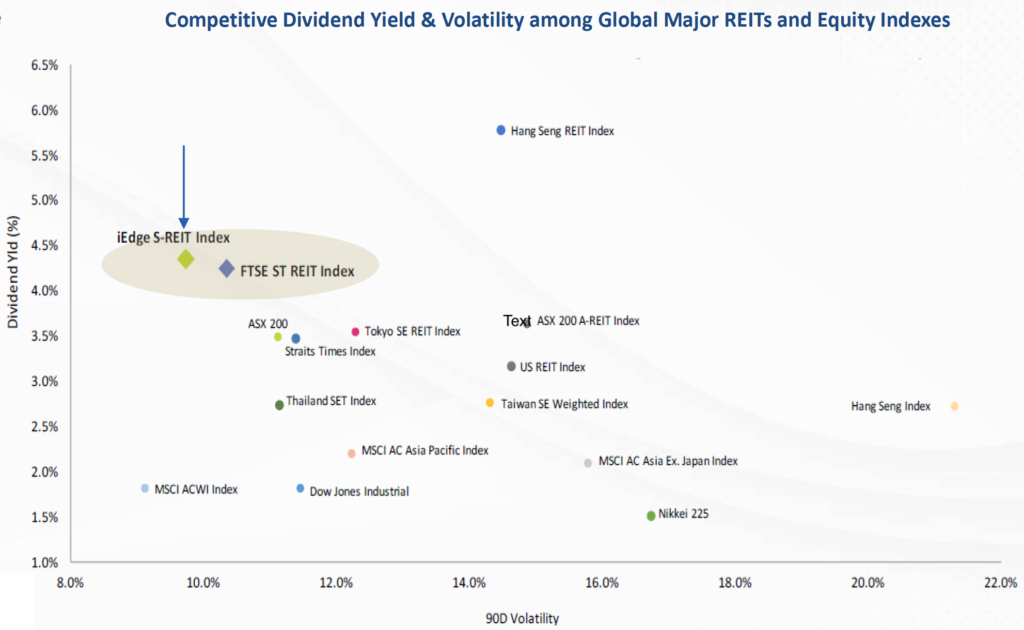

Online subscription for the ETF is now open during the Initial Offer Period IOP online from 29 October 2021 till 15 November 2021 by 930am. SRU adopts a replication strategy to track the performance of the iEdge S-REIT Leaders Index presenting the investment opportunities of the S-REITs market which is well known for its sustainable income stream and potential capital appreciation.

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Your REIT with Risk Management portfolio will always have a REIT allocation of at least 50.

. SINGAPORE November 11 2021--CSOP Asset Management will list its second Exchange-Traded Fund ETF on SGX - CSOP iEdge S-REIT Leaders Index ETF Stock Code. It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396. Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source.

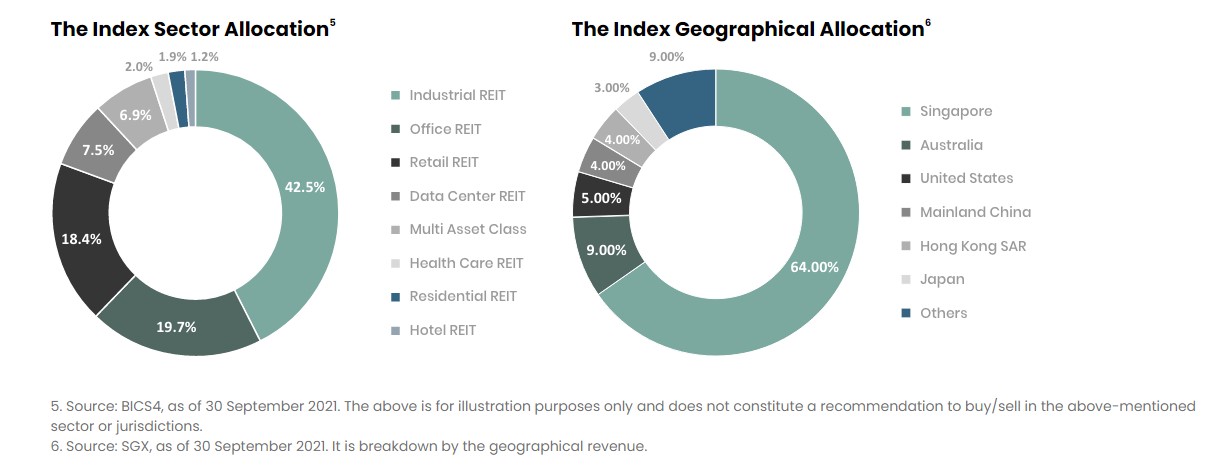

Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet. Constituents must be listed on SGX and classified under Reits as defined by the Factset Revere Business Industry Classification System. SGX as of 30 September 2021 5 Source.

IEdge S-REIT Leaders Index USD - Singapore Exchange SGX Loading. Advised by JLP Asset Management Asia Pte. If we assume dividends are not reinvested the returns would have been 431.

The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. The index is one of Singapores most popular REIT indices. CSOP Asset Management a Chinese asset manager based in Hong Kong has announced that it will list the CSOP iEdge S-REIT Leaders Index ETF on the SGX this month under the symbol SRT.

To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy. In other words there is a minimum of 50 REIT for this portfolio. Since 2017 investors have had a choice between three REIT ETFs on the Singapore Exchange SGX.

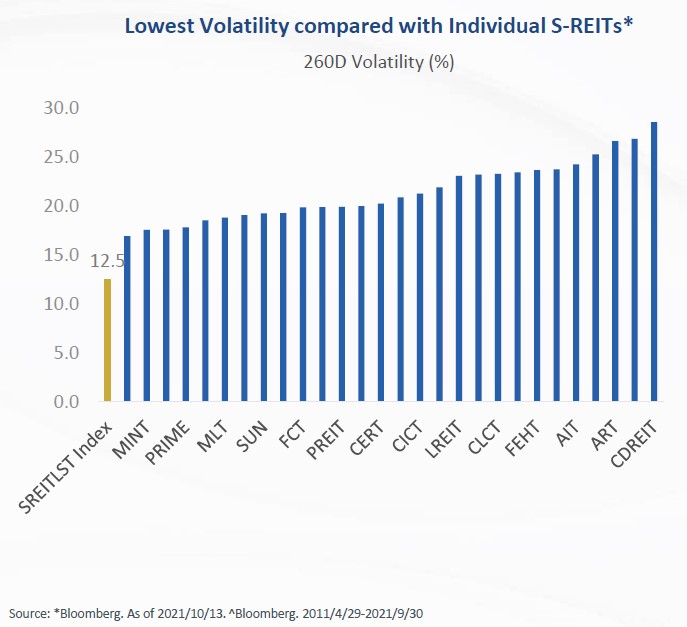

Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. Liquid Real Estate Exposure. The iEdge S-Reit Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid trusts in Singapore.

Investors holding a REIT can enjoy. If youre looking to build a diversified REIT portfolio the iEdge S-REIT Leaders Index is one option to consider. Historical data for the CSOP iEdge S-REIT Leaders Index ETF CSOP as well as the closing price open high low change and change.

Tune in to Growth Track Podcast. Growth Track is SGX Groups podcast series where we focus on investment and growth opportunities across Asia. SGX as of 30 June 2021 6 Source.

The REIT component in this portfolio also tracks the SGXs iEdge S-REIT Leaders index. CSOP iEdge S-REIT Leaders Index ETF factsheet Which means this Singapore REIT ETF projects to pay a higher dividend yield of 53. Not too bad for buying a diversified REIT ETF.

The latest 12-month dividend yield is at 408 as of 31 October 2021. A real estate investment trust in Singapore S-REIT A fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a view to generating income for unit holders of the fund. After paying its expense ratio of 06 thats about 47.

IEDGE S-REIT INDEX REIT REIT SGX. CSOP iEdge S-REIT Leaders Index ETF Stock Code. The iEdge S-REIT Leaders Index ETF is a diversified and return-focused ETF that provides investors with exposure to some of the most important uprising industries in real estate in different geographical locations with Singapore being the.

Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX. View live IEDGE S-REIT INDEX chart to track latest price changes. See more on advanced chart See more on advanced chart.

IEDGE S-REIT INDEX SGX. It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore. What I dont like about this is theres no track record for this ETF.

SGXREIT trade ideas forecasts and market news are at your disposal as well. In terms of sustainability of its yield from my understanding the iedge s-reit leaders index is projected to deliver a growth of 593 and a yield of 543 in 2022 according to bloomberg terminal as at 30 september 2021 and highlighted in rectangular boxes below and as the csop iedge s-reit leaders etf tracks the performance of this index. With the soon to be listed CSOP iEdge S-REIT Leaders Index ETF investors will now be able to invest in S-REITs via an ETF to reap its diversification benefits.

SRU on 18 November 2021 and the initial offering period has already started on 29 October 2021. It tracks the largest and most liquid REITs in Singapore including household names like Ascendas REIT Mapletree Commercial Trust and CapitaLand Integrated Commercial Trust. Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC.

Bloomberg CSOP 6 May 2016. That is set to change with a fourth option entering the fray. Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested.

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

S Reit Report Card Here S How Singapore Reits Performed In Fy2018

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Singapore Reit Etfs Guide Comprehensive

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Syfe Reit 100 000 Portfolio Review And 3 Things You Probably Didn T Know About It Turtle Investor

南方东英iedge新加坡房地产投资信托领先指数etf将在新交所上市 Business Wire

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

What You Need To Know About Csop Iedge S Reit Leaders Index Etf The Singaporean Investor

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf Poems

0 Response to "iedge s reit"

Post a Comment